With the state of the current financial situation in the UK, you may well be concerned that your money isn’t going as far as it did before.

Inflation surged throughout 2022, with the Office for National Statistics (ONS) recording the Consumer Price Index (CPI) to have risen by 10.5% in the 12 months to December 2022.

Meanwhile, the outlook for 2023 remains equally concerning. In fact, the BBC reported back in November 2022 on the Bank of England’s expectation for the UK to fall into its longest-ever recession.

This may leave you concerned that you need to find areas to cut back in and, worryingly, it appears that financial protection may be on the chopping block for many Britons.

According to Professional Adviser, only one in three people recognise protection as a “non-negotiable priority”. Furthermore, 13% of individuals even said they would consider cancelling their life insurance to help them navigate the cost of living crisis.

In reality, financial protection such as life insurance, income protection, and critical illness cover is just as – if not even more so – important during times of economic difficulty.

Here’s why.

Protection is often cheaper than you think

First and foremost, the cost of protection is often far lower than you might expect. As a result, allowing cover to lapse might not make the difference you’re hoping for in reducing your expenditure when times are tight.

A study by Legal & General makes for particularly interesting reading on this subject. The insurance provider surveyed millennial adults aged between 25 and 34 and asked them what they thought the monthly cost of life insurance would be for a 30-year-old non-smoker with a cash sum of £100,000 for 30 years.

Interestingly, the median guess for this age group was £23 a month – more than three times the actual answer of just £7.27.

While millennials were most likely to overestimate the figure, this misconception was not limited to younger people. Indeed, 11% of Generation X (defined as those born between 1965 and 1980) respondents thought that the average cost would be £50 a month, as did 7% of baby boomers (those born between 1946 and 1964).

So, whether you fall into the “millennial” age bracket or not, you may be overestimating just how much it costs for you to have your protection in place.

There are two reasons that this may make keeping protection in place throughout the cost of living crisis worth it:

- You wouldn’t actually save as much as you think, meaning it would make very little difference to your overall financial situation to allow your cover to lapse.

- It will continue to provide essential protection for you and your family if the worst happens.

Check to see how much you’re paying for protection – you might realise that it’s worth it, especially for what you receive in return.

In uncertain times, knowing you’re covered can offer immense peace of mind

Of course, the question of “what you receive in return” is a significant factor in determining the value of the protection you have.

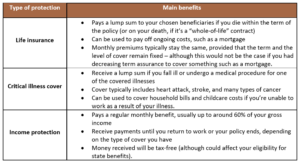

The answer is knowing what it is that your protection offers you. The table below shows you the main benefits of having life insurance, critical illness cover, and income protection in place.

Crucially, one of the biggest benefits of protection is the peace of mind it can provide, especially during uncertain times. Indeed, according to US protection information nonprofit Life Happens, 65% of consumers with life insurance say that they’re able to enjoy life more knowing that their families will be covered if anything were to happen to them.

Knowing that you’re covered in the event that you were to become too ill to work or even pass away can offer valuable reassurance, providing you and your family with the certainty that you’ll still be financially stable during difficult circumstances.

Your cover might be able to help with unexpected consequences of the cost of living crisis

Another aspect to consider is that your protection may be even more important because there’s a cost of living crisis.

For example, imagine that the worst happened and you passed away unexpectedly. This could leave your family financially stricken, struggling to afford bills or mortgage repayments without your income.

Now consider how mortgage interest rates have risen over the past few months, and where they could go over the next year – indeed, Money to the Masses reports that two-year fixed-rate mortgages could reach 5.6% by the middle of 2023.

If your family need to remortgage after you’ve passed away, they might suddenly be facing larger mortgage repayments without your income.

This is potentially a double crisis for them – they’d be dealing with the additional stresses of the cost of living crisis, alongside the emotional and financial impact of losing you.

Meanwhile, if you had kept your life insurance cover in place, your family would be able to use this money to pay off your outstanding mortgage.

While this will in no way fill the gap that you’ve left behind, it will at least ensure that your loved ones would be able to remain in your home.

At times of economic uncertainty like this, knowing that there’s cover in case of the unexpected can provide some much-needed stability.

Get in touch

Whether you’d like to review the protection you have in place, or any other aspect of your financial planning, we can help at Cordiner Wealth.

Email hello@cordinerwealth.co.uk or call 0113 262 1242 to speak to an experienced adviser today.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Note that life insurance plans typically have no cash in value at any time and cover will cease at the end of the term. If premiums stop, then cover will lapse.