It’s been almost impossible to miss the stories about inflation that have dominated the news over the past few months.

Rising prices throughout the UK have culminated in the highest spike in inflation in 30 years, as the Office for National Statistics (ONS) recorded that the Consumer Prices Index (CPI) rose by 5.5% in the 12 months up to January 2022.

As experts continue to express concern over the rising cost of living, you may be wondering how inflation actually affects you.

So, here’s what inflation means for your money, and three things you could do about it.

Eroding the value of your money

First of all, it’s useful to understand what inflation means in a practical sense.

Imagine goods or services that cost £100, such as a high-end coffee machine. A year of inflation at 5.5% would see that coffee machine increase in price to £105.50 in a year’s time.

Meanwhile, imagine you have £100 in a savings account. Let’s assume you were receiving 0.75% interest – the highest rate on an easy-access account according to Moneyfacts, as of February 2022.

After a year of saving, your £100 would only receive 75 pence in interest, giving you £100.75. So, while you could afford that coffee machine a year ago, the rising cost of living means you’d no longer be able to with that money.

That means your money has lost value compared to the wider economy in real terms.

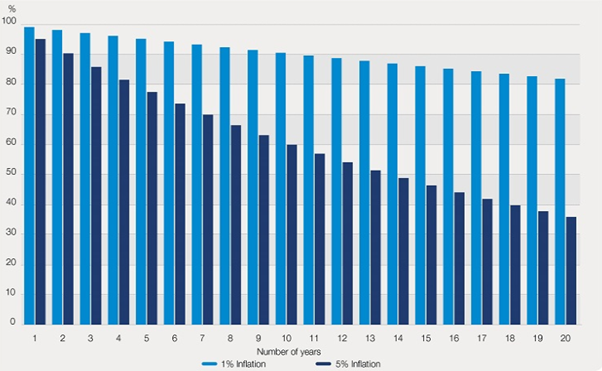

Over time, this issue becomes even more pronounced. The chart below shows how the spending power of money decreases in percentage terms at 1% and 5% inflation over 20 years:

Source: Schroders

As you can see, it only takes two years for your money to have 90% of the spending power it previously did if inflation continues at a rate of 5%.

Inflation and retirement

In retirement, inflation can be even more damaging. While the State Pension will usually rise at least in line with inflation each year, your retirement income may fail to keep up with the cost of living.

This can be an issue, primarily because this income is somewhat finite after you stop working. Unless you’ve made decisions that inflation-proof your money, you could find rising prices eating into your retirement savings quicker than you thought you would.

In turn, this can have a knock-on effect on your desired lifestyle, potentially preventing you from achieving your later-life goals.

3 ways to hedge against inflation

As a result, it’s important to find strategies that can allow you to protect your money from the eroding effect that inflation can have.

Here are three things you could consider doing.

1. Reduce how much you hold in cash

The first thing you should consider is how much you’re holding in cash, particularly if you’re already retired.

Having cash in the bank or an emergency fund set aside is incredibly useful. But the more you hold, the more of your money is at risk of falling behind the rising cost of living.

Indeed, this appears to be no small issue for retirees. Figures obtained by consultancy firm LCP and published by Professional Adviser show that three million pensioners hold all their ISA savings in cash.

That puts all the money in these accounts at risk of losing value in real terms.

So, review your savings accounts, including your emergency fund, and see whether you’re holding more in cash than you need to.

In an inflationary environment, it can even make sense to use this cash to pay off high-interest debt or make overpayments on a mortgage, rather than hold onto cash that’s losing spending power.

2. Invest in the stock market

Another way it may be worth using your cash is by investing it in the stock market. Historically speaking, returns on investments have managed to outperform the rate of inflation.

Investment platform IG looked at the performance of the average returns of the FTSE 100 from its inception in 1984 up to 2019.

In that time, investments on the index produced an annualised price return of 5.77%, and an annualised total return of 7.75%. Meanwhile, according to the Bank of England’s inflation calculator, inflation only rose by 3.4% each year during this period.

That means carefully placed investments in the FTSE 100 during this period would have outpaced the rate of inflation.

As a result, you may want to consider investing some of your money, targeting returns that at least keep it in line with inflation.

Of course, it’s important to remember that past performance is not an indicator of future performance. Investing is inherently risky, and you may get back less than you invest.

3. Purchase an inflation-linked annuity

If you’re approaching or in retirement, one other option you could consider is using your cash to buy an inflation-linked annuity. This offers you guaranteed retirement income that should retain its value over time.

An annuity is a type of insurance product that pays you a fixed income, typically for the entirety of your retirement. You’ll pay upfront for this product and the provider will then calculate the amount you’ll receive based on factors such as your age, health, and lifestyle.

Of course, as the name suggests, the amount you receive with an inflation-linked annuity will increase each year in line with the rate of inflation.

That means the retirement income you receive will rise with wider economic circumstances, which should theoretically mean it has the same spending power year-on-year.

Speak to us

Whether you’re still in work or already retired, inflation can have a severe impact on your entire financial situation.

If you’re concerned about how it could affect you, please get in touch with us at Cordiner Wealth. We’re experts in helping people to manage their money, no matter the wider economic circumstances.

Email hello@cordinerwealth.co.uk or call 0113 262 1242 to find out more.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.