On 3 November, the Bank of England (BoE) confirmed yet another increase to its base rate, raising the rate to 3% in the largest single increase since 1989.

Banks, building societies, and other financial institutions use the base rate to determine the rate of interest they pay on their savings accounts. This has seen savings interest rates rise notably over the past few weeks.

Indeed, according to Moneyfacts, the highest available rate on an easy access savings account was 2.65% as of 15 November – a sizable increase from some of the rates you may have become accustomed to over the past couple of years.

However, while rising interest rates mean you’ll see a greater return on your money, it may also increase your likelihood of paying Income Tax on it.

That’s because your total interest generated might be pushing you closer to exceeding the Personal Savings Allowance.

So, find out how the Personal Savings Allowance works, why you might now be in danger of overstepping the threshold, and what you could do to avoid paying tax on your savings interest.

Interest on your money will be tax-free up to the Personal Savings Allowance

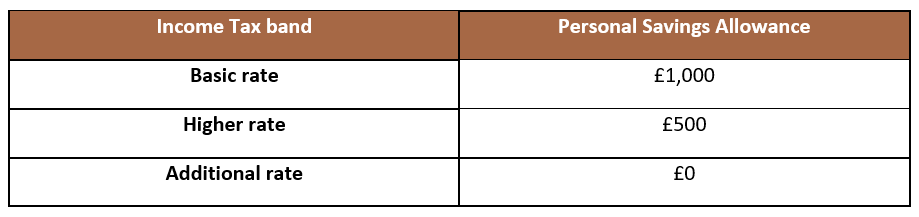

The Personal Savings Allowance is a threshold for how much interest you can generate on your savings before you have to start paying Income Tax on it. The size of your Personal Savings Allowance is determined by your marginal rate of Income Tax.

The table below shows you how much your Personal Savings Allowance is in the 2022/23 tax year, depending on which Income Tax band you fall in:

While these thresholds might seem high for basic- and higher-rate taxpayers, it wouldn’t take much for you to exceed them.

If you had £50,000 savings held in the 2.65% rate easy access account mentioned earlier, you would exceed the basic-rate threshold in just one year of saving. Meanwhile, you would cross over the limit in just six months as a higher-rate taxpayer.

For earners in the additional-rate tax band, you’ll have no Personal Savings Allowance at all. That means any interest your savings generate will be liable to 45% Income Tax.

Saving through a Cash ISA will see all interest paid to you tax-free

One option you have to avoid paying Income Tax on your cash is by saving your money in a Cash ISA.

Each tax year, you can save up to the ISA allowance (£20,000 in 2022/23) across the range of ISAs available. Any interest your money then generates will be entirely free from Income Tax.

So, by saving in a Cash ISA instead, any interest you receive won’t be liable to Income Tax, no matter which tax band you fall in.

Investing your money might be a more effective option

Despite interest rates increasing, investing your money may still be preferable. That’s because invested money typically outperforms cash savings over time.

In fact, Barclays Smart Investor collated data on this subject over the 20-year period from January 2001 to 31 December 2021.

These figures show that, had you held your money in cash over this period, £10,000 would have been worth £17,757.

Meanwhile, £10,000 invested in UK large-cap shares (represented by the FTSE 100) would have been worth £23,286.

For all UK shares (represented by the FTSE All-Share) this figure rose to £27,417, and was £40,515 for developed market shares (represented by the MSCI World Index).

As a result, even though you can currently generate more interest on your cash than you might have been able to previously, investing your money is still likely to be a more effective tool for growing your wealth in the long term.

And, because your investments can be held in a Stocks and Shares ISA, your returns can be entirely free from both Income Tax and Capital Gains Tax (CGT) too.

So, not only will you have the potential to grow your money more effectively than you typically can with a savings account, but you can also do this tax-efficiently.

This might be a better use of your ISA allowance than using it just to save yourself on a sliver of Income Tax on savings interest.

Speak to us

If you’d like to find out how to save and invest your money to reach your financial goals, please get in touch with us at Cordiner Wealth.

Email hello@cordinerwealth.co.uk or call 0113 262 1242 to speak to us today.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.