Every business owner knows the importance of cashflow forecasting and using accurate data to make financial decisions.

But have you considered how important cashflow planning and forecasting is for your family finances, as well as your business?

In the grand scheme of things, the data you produce from forecasting in your business is really management information for your personal finances.

As a result, you may want to consider syncing up your business finance planning with your wider financial plan, so that your money is pulling in the same direction towards your goals.

Find out everything you need to know about cashflow forecasting with your family in mind to help make sure that your business is supporting your personal finances.

The issue of cash flow for business owners

Cashflow forecasting is a simple and effective tool at your disposal that gives you concrete data over how much money you have, and how much you need.

In essence, a cashflow forecast is a lot like a budget. Using planning software, you input projections of your expected income and expenses of your business. The software will then create a forecast of the flow of cash coming in and out over a specified period.

This information is invaluable for making decisions about funding, expenditure, and how much you can afford to take from your business at particular times.

Of course, it’s not guaranteed that the information generated by the forecast will be positive. Indeed, it may very well instead uncover oversights and problems with your cash flow.

The biggest issue that you’re likely to uncover using a cashflow forecast is that there’s too much money going out and not enough coming in.

While this may be a temporary issue or one that doesn’t seem particularly severe, it could become terminal for your business and threaten your ability to continue operating if you don’t address it immediately.

In the long term, this can become a serious issue for your family, as it’s likely that you at least partially rely on money generated by your business to live on, or potentially even plan to in retirement.

As a result, it’s vitally important for your overall financial health to stay on top of cash flow.

Solving a cash flow issue

Fortunately, cash flow issues are ultimately very solvable. There are plenty of strategies you can employ to improve your situation.

From checking your cash flow health in the short, medium, and long term, to working out the best strategies to derive income from your business, it’s simply a case of finding the right way to do it for you.

When you’re collecting data like this, it’s often sensible to hold all of it in one place. For example, you might use accounting software such as Xero in your business that helps you to keep track of all your money in one convenient system.

Cashflow planning is just the same. It’s often easiest to make informed decisions when you have all this information on display in front of you at one time. That’s why it can be useful to combine business and personal planning in one place.

The key thing to remember with data like this is that it must be actionable. Collecting data is only as useful as knowing what to do with it once you have it.

That’s why you need to make sure that the data you collect will actually serve a purpose for you.

How Cordiner Wealth can help you, your business, and your family

When you need to solve a cash flow issue, there’s no substitute to working with a professional financial planner.

That’s why, at Cordiner Wealth, we offer comprehensive cashflow planning services that can transform your relationship with your business and personal finances, ensuring that both work for you and your family.

We use Voyant, a state-of-the-art cashflow planning suite, to generate insights into your finances and show you detailed information about your situation.

We can model a variety of scenarios for your money, looking over the short, medium, and long term. This can show you everything from how your business will fare over the next few months, to how it will be able to support you down the line.

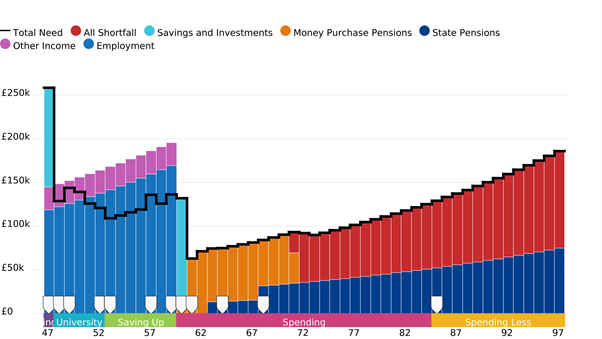

Here is an example of a cashflow before working with Cordiner Wealth:

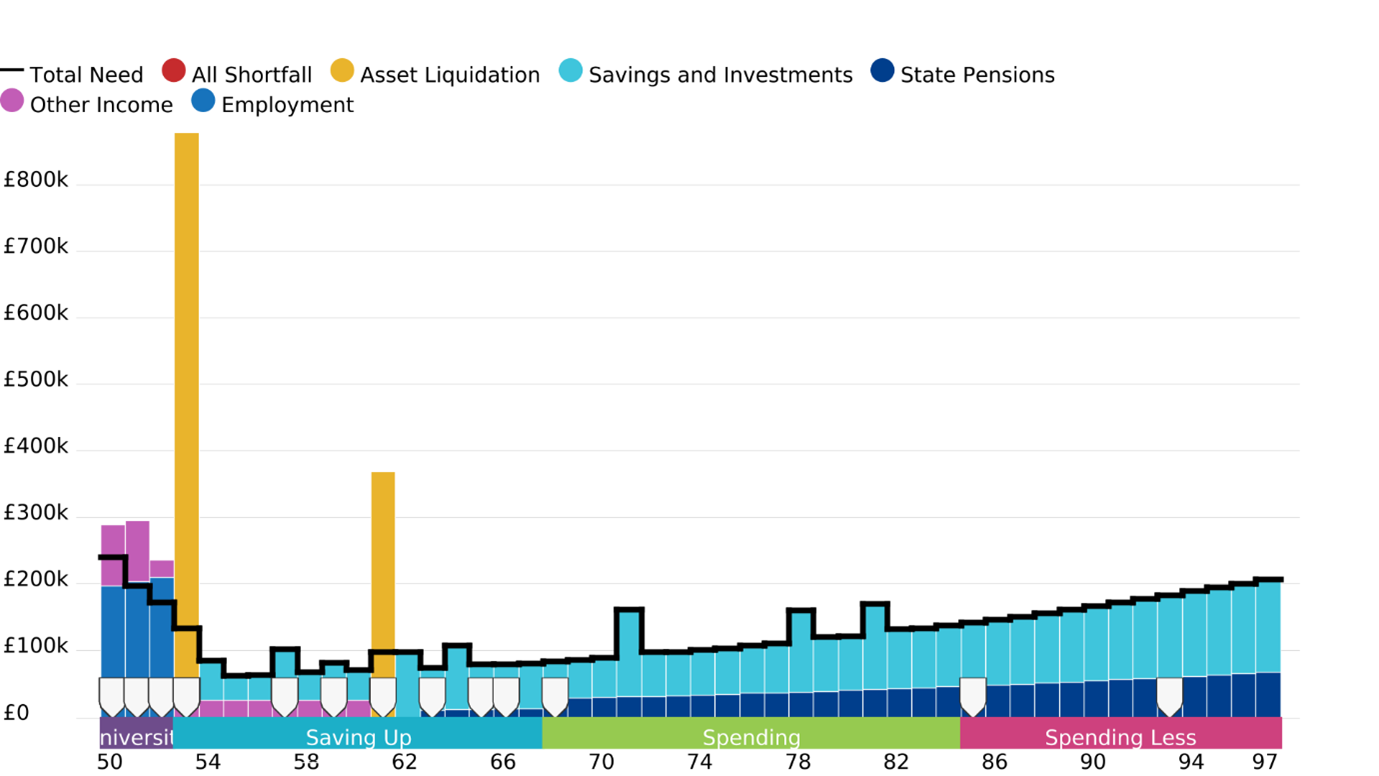

Here is how the cashflow changed after we implemented our recommended strategies:

As you can see, the methods we can put in place can bring any potential shortfall well within a manageable range.

This can also include forecasting for risk and disaster scenarios, giving you information that can help you make informed decisions over how to protect your family in the event of an emergency.

As part of this, we can look at your most efficient ways of extracting money from your business. Whether that’s using tax allowances to draw income or even planning how you’ll exit your business in future, it’s vital to know how you’re going to use the value contained within it.

Crucially, once we have this data, we’ll be able to include the forecasts for the various business scenarios as part of your wider financial plan as a whole, looking at strategies that will refine your plan even further.

All in all, this information will help to give you more clarity and greater peace of mind that all the hard work you’re putting into your work is actually driving you towards your life goals.

Work with us

If you’d like to find out more about how our services could help you and your family, please get in touch with us at Cordiner Wealth.

Email hello@cordinerwealth.co.uk or call 0113 262 1242 to speak to us.