By all accounts, the second half of 2024 has been positive for the UK financial market.

In August, Money Marketing noted three graphs identifying key markers that UK equities were in a strong position, showing:

- The UK economy performing well, relative to the US, Europe, and Japan

- UK inflation under relative control, especially compared to the US

- Competitive valuations for UK equities.

Investment professionals also noticed this trend, as September 2024 marked the first time in three years that global fund managers built an overweight position in UK equities, Investment Week reported.

If you had read this information, you may well have wondered whether adopting more UK equities would have been an effective financial decision.

Yet, doing so could have actually led you to be over-exposed to UK equities. In fact, you might have a “home bias” towards UK-based investments. This is a psychological tendency to favour companies based in your home country, and could potentially be detrimental to your wealth.

Find out why it’s important to be aware of home bias, and how a diversified portfolio may be more appropriate in helping you to achieve your long-term goals.

The UK is a significant world economy, but also a small sliver of the stock market

You could easily fall victim to home bias and unwittingly favour UK assets simply because they’re the ones you’re familiar with, rather than being suitable for your wealth strategy. You might know the names of the companies you’re investing in and feel more comfortable putting your wealth in them.

Investing some of your wealth in UK equities is by no means incorrect. Provided that you do your due diligence and they suit your risk tolerance and investment targets, such investments could be a useful part of your portfolio.

Indeed, as Investopedia explains, the UK is the sixth-largest economy in the world. Meanwhile, as noted by City AM, the UK has many top-performing sectors including:

- Arts and music, boasting the third-largest music market in the world in 2023

- Financial services, being the world’s largest net exporter in 2022

- Technology, with a market valuation of $1.1 trillion, including 171 unicorns (start-ups valued at over $1 billion).

However, despite all this performance, the UK makes up just a tiny fraction of the entire world market.

According to Funds Europe, UK equities comprise just 4% of the total global stock market. For comparison, the combined value of Europe and Japan is 20%, with the US dominating at a somewhat remarkable 65%.

Logically, this would suggest that in a global investment portfolio, you wouldn’t want to have more than 4% UK equities. Otherwise, you could be over-exposed to the UK market.

Yet, in 2023, Barclays research found that UK equity home bias has been estimated to be approximately 25% of an allocation – far exceeding the 4% of total markets that the UK really makes up.

So, your home bias may well mean that your portfolio is overweight in UK equities, relative to the value of the world’s markets.

A well-balanced and diversified portfolio can be key to success

Investing titan Warren Buffett is known for having encouraged a strategy of only investing in what you know. Buffett has always focused on the investments he understands, and in fairness has achieved impressive success as a result.

However, taking this advice literally and only investing in UK markets and over-exposing your portfolio to your home market could potentially be an error.

Instead, it can be sensible to pursue a well-balanced and diversified portfolio. That way, you have exposure to a combination of assets from around the world, allowing you to capitalise on opportunities from all different markets.

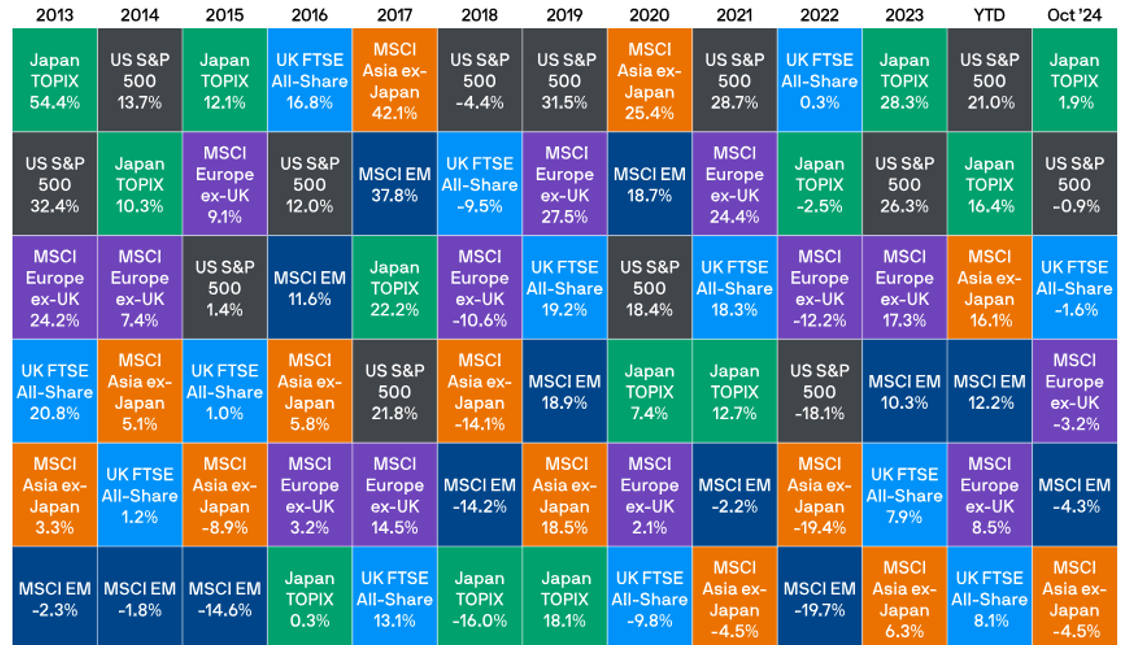

Consider this asset quilt from JP Morgan, showing the performance of some of the world’s biggest market indices from the past decade:

Source: JP Morgan

As you can see, the top-performing index in one year can fall to the bottom in another, and vice versa. So, constructing a portfolio with a range of assets spread across different parts of the world could help you generate returns over time.

Furthermore, diversification can be a useful tool for risk management. Risk is inherent in investing, and your investments could lose value as a result of various factors, whether that’s down to individual company performance or a political event affecting an entire country.

Yet, by spreading your holdings across multiple industries, sectors, and regions, you may be better positioned to ride out a period of volatility. For example, if your UK assets temporarily dropped in value, your losses might be offset by gains in Asia or the US.

Again, consider the asset quilt. Had you only been exposed to the UK market in 2020 when the FTSE All-Share fell by 9.8%, your entire portfolio could have fallen in value.

Meanwhile, if you had invested at least partially in Asian equities, the 25.4% returns generated by the MSCI Asia ex-Japan could have offset some of the losses you experienced on your UK holdings.

As you can see, spreading wealth across different areas could be an effective way to manage risk and ensure that your entire portfolio is less likely to fall in value at one time.

Get in touch

If you’d like support in avoiding home bias and designing a balanced portfolio that helps you achieve your goals for the future, we can help at Cordiner Wealth.

Email hello@cordinerwealth.co.uk or call 0113 262 1242 to speak to us today.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.