When starting out, many investors are either put off by the risk of losing their money, or quickly become frustrated that their investments don’t grow overnight.

In reality, investing is not typically a way to make a quick buck. Rather, it’s a long-term strategy with the best results achieved over many years.

Think about the performance of the FTSE100 over the last twenty years: the index has weathered two crashes this century, and yet it has still offered returns of 130% in the past two decades.

That’s why you should think of your investing journey not as a one-off 100-metre sprint, but as the annual London Marathon.

So, what lessons can you learn from marathon runners to inform an investment strategy?

Preparing and training

No one runs a marathon overnight; there are months of training in the gym and hours of running before you’re ready to get out there and tackle the real thing.

Your investing journey should start in a similar way. Take a thorough look at your finances and see what you can afford to invest. There’s no exact amount for this as it will be specific to you, but a good rule to follow is to only invest money you won’t need to live your daily life.

Take the time to figure out what you’re investing for and what you want to achieve. Just like a runner setting a time target, this will inform your strategy and give you an idea of where you need to be by each stage.

By taking the time to work this out first, you can be confident that you’re not overstretching your finances, and you’ll be more likely to hit the targets you set yourself.

Getting started on the road

The first few miles of a marathon are key to the outcome of the race, with runners needing to pace themselves properly early on. Runners often rely on the advice of running coaches for how to handle this stage, using their experience to inform their technique and strategy.

Pacing your investing by drip-feeding your money into the market is a good blueprint to follow. There are two key benefits to doing this when you’re making a start:

1. Investing smaller amounts over a longer period tends to be more manageable for your pocket. This way, you’re more likely to only invest what you can afford.

2. You can spread out the risk of market dips by investing at different times. A piece-by-piece approach can help account for peaks and troughs in the markets. This is known as “pound-cost averaging” and involves spreading out your investments to reduce the risk of your whole portfolio losing value in one go if the market dips.

Much like the wise words of a coach, this is also the stage where a financial planner can be valuable for you as an investor. A planner can give you personalised advice to help you make investment decisions that guide you through the whole of your journey.

Be prepared for the harder middle miles

The middle of a marathon is notoriously difficult, as fatigue sets in and the anxiety of not making it to the end reaches its height. Runners refer to this as “hitting the wall” and they use a plethora of mental tactics to fend off negative thoughts and feelings to drive themselves on to the end.

In the same way, the key to a good, long-term investment strategy is to be patient and keep going. Markets will rise and fall as they always do, and it’s vital to not allow temporary dips to put you off your stride.

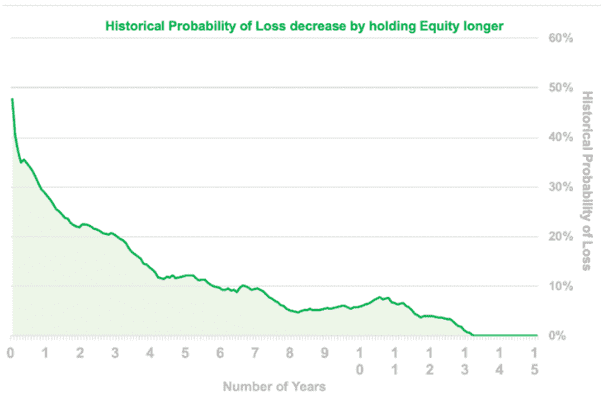

When investments fall in value, the kneejerk reaction for many investors is to sell. However, this may be counterproductive, as evidence shows that spending more time in the market means a lower chance of losses.

Research from Nutmeg shows that the longer you hold your investment, the less chance you have of losing money at all. In fact, using global stock market data, Nutmeg found that holding an investment for 13 years or more reduces the probability of loss to almost zero.

Source: Nutmeg

There’s no shame in selling an investment that doesn’t appear to be working out. But holding your nerve can be the best way to achieve the result you want.

Again, the advice of a financial planner can make all the difference here, as they can give you the guidance you need to make informed decisions when it comes to your investments.

Most runners take on marathons for the personal achievement

Save for a few professional athletes, most people who take on the London Marathon do it to achieve a personal best time just for themselves. This is the exact attitude you should take with you when investing.

Your investment goals should be personal to you and based on what you want to achieve out of life, rather than competing with everyone else. There’s no need to worry about what other people are doing, or the hundreds of investment tips you might see online; just stick to running your race as well as you can.

Want to start your investing journey?

If you’d like help running your investing marathon, please get in touch with us at Cordiner Wealth. We can provide a tailor-made plan and personalised advice on the right investment options for you.

Email hello@cordinerwealth.co.uk or call 0113 262 1242 to find out how we could help you.

Please note:

The value of your investment (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.