With the government’s confirmation of a 3.1% rise to the State Pension, you may now be wondering what this will mean for you.

So, if you’re retiring soon, find out how much you can expect to receive after the increase to the State Pension and what this will mean for your retirement.

Up to an extra £288 a year in State Pension

The government has now confirmed that the State Pension will increase by 3.1% for the 2022/23 tax year. That means, if you’re at or over the State Pension Age of 66 at this point, you’ll be entitled to these increased rates of State Pension.

The amount of State Pension you’ll receive depends on whether you get the basic State Pension or the new State Pension.

You’ll receive the basic State Pension if you’re a man who was born before 6 April 1951, or a woman born before 6 April 1953. You need at least 30 qualifying years of National Insurance contributions (NICs) to be eligible for the full basic State Pension.

Meanwhile, you’ll receive the new State Pension if you’re a man born on or after 6 April 1951, or a woman born on or after 6 April 1953. You need a minimum of 10 qualifying years of NICs to receive any new State Pension, and at least 35 years to receive the full amount.

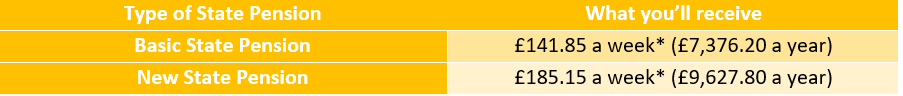

As of the 2021/22 tax year, the current full State Pension amounts are:

Then, from the new tax year starting on 6 April 2022, the State Pension will increase by 3.1% to:

*Rounded to the nearest 5 pence

This increase, according to consumer rights group Which?, could provide pensioners with an extra boost of up to £288.60 for the year, depending on which type of State Pension you receive.

Triple lock suspension means the increase should have been higher

The triple lock suspension has been the big talking point over the State Pension increase in the last couple of months.

Essentially, the triple lock means that the government is committed to raising the State Pension each year to ensure that the amount pensioners receive is in fitting with wider economic circumstances.

Ordinarily, the government increases the State Pension based on one of these three (hence “triple”) elements, using whichever is highest to inform the decision:

1. A flat increase of 2.5%

2. Average earnings growth from May to July, year-on-year

3. Inflation in the year to September, based on the Consumer Price Index (CPI).

However, for the coming 2022/23 tax year, the highest of these figures was set to be average earnings growth, which had climbed as high as 8% due to the impact of the Covid-19 pandemic on the job market.

As a result, the government reverted to using the CPI figure as the basis for the increase, resulting in the 3.1% rise that will now come into effect next April. That means, in this instance, the State Pension is protected by a “double lock”.

The State Pension is the bedrock of your retirement

While the amount that the State Pension pays is unlikely to be enough to exclusively live on, it’s worth remembering that it can still play a significant role in your retirement.

Having guaranteed income like this can help to ensure that you’re able to afford your food shopping and cover other household bills, even if your other retirement income takes a dip for any reason.

For example, an invested private pension might temporarily lose value due to market movements. Meanwhile, the State Pension isn’t subject to the same pressures, so it can be reassuring to know that you’ll still have income no matter what happens.

Additionally, even though the triple lock was suspended this year, the State Pension will continue to rise in line with economic activity each year. This could help to ensure that what you receive will retain its spending power, even over time.

Crucially, your State Pension payments can also free up the money in your workplace or private pensions so that you can use it to reach your retirement goals.

Rather than having to use the money you saved and invested throughout your working life to fund basic expenses, having State Pension payments to pay your daily living expenses can leave you to spend the rest of your pot as you wish.

That means any increase in State Pension benefits can help to take pressure off your funds for achieving your life goals.

Work with us

If you’d like to find out more about how the increase to the State Pension will affect you, or you’d like help working out how to achieve your retirement goals in general, then please get in touch with us at Cordiner Wealth.

Email hello@cordinerwealth.co.uk or call 0113 262 1242 to speak to us.

Please note

A pension is a long-term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits.