Inflation in the UK has been high for an extended period of time now, having exceeded the Bank of England (BoE) target of 2% every month since May 2021.

The rate of inflation did slow in the 12 months to July 2023. In fact, the Office for National Statistics (ONS) recorded inflation in this period to be 6.8%, down from 7.9% in the 12 months to June 2023. However, this is still far higher than the BoE’s target.

A great deal of the conversation around inflation focuses on the way that it erodes your wealth’s real-term value – that is, your money loses some of its spending power as its value remains the same, while the cost of goods and services is increasing.

Yet, there is actually another danger that inflation can present: fiscal drag. This relates to the relationship between inflation and frozen tax thresholds.

So, find out what fiscal drag is, why it can affect your money, and how you can manage your wealth if you’re now paying more tax as a result.

Fiscal drag sees you pulled into paying more tax

Fiscal drag essentially sees you pulled into paying more tax as tax thresholds don’t keep up with the rising cost of living.

There’s a danger of this happening to your wealth because the government has frozen various thresholds, and even reduced other tax allowances and exemptions. As a result, more of your wealth may be liable for tax.

There are various taxes that you may see affect your wealth as a result of fiscal drag, but perhaps the most important is Income Tax.

The Income Tax bands were originally frozen until 2026 by then-chancellor Rishi Sunak in 2021.

However, current chancellor Jeremy Hunt extended the freeze to these bands until 2028, while also reducing the threshold at which additional-rate tax becomes payable.

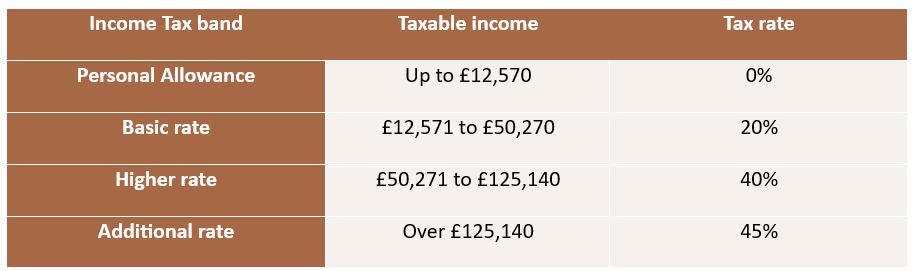

As a result, the Income Tax bands in 2023/24 – and where they are set to be until 2028 – are as shown in the table below:

The issue with frozen Income Tax bands is that, usually, the thresholds are raised over time to account for rising inflation. Similarly, your earnings will also typically increase to ensure that your income keeps pace with the rising cost of living.

However, if the thresholds are frozen, that means you may be pulled into a higher tax band when your earnings increase.

For example, imagine that you’re currently employed and earning £50,000 a year. That means you pay basic-rate Income Tax on your earnings over £12,571.

As inflation has been so high, your employer decides to increase your salary by July’s inflation figure of 6.8%. That means you’re now earning £53,400.

Of this amount, £3,130 exceeds the higher-rate threshold, meaning you now pay 40% Income Tax on this amount.

According to the Institute for Fiscal Studies (IFS), more adults than ever before are paying higher rates of Income Tax as a result of the freezes.

11% of UK adults paid a higher rate in 2022/23, compared to just 2.5% in 1991/92. The IFS also forecasts this to rise to 14% by 2027/28.

Fiscal drag can affect you whether you’re still working or retired

Fiscal drag could be a concern whether you’re retired or still working. That’s because your retirement income could be affected in just the same way by frozen thresholds.

Consider this example of how the frozen Income Tax bands could affect you.

Imagine that you look to draw a tax-efficient income in retirement. You and your spouse might draw income from your pensions right on the boundary of the Personal Allowance to avoid paying Income Tax.

Assuming you have no other income and have already used your 25% tax-free pension lump sum, this would give you an annual income of £25,140 in the 2023/24 tax year.

But, if inflation was 6.8% for a year, that means you would need £26,849 next year for your money to go as far as it did 12 months before.

With the Personal Allowance frozen where it is, the extra £1,709 you’d then have to draw between you from your pensions would be subject to Income Tax.

So, you can see how fiscal drag can affect you, even if you’re retired.

Making pension contributions can protect your wealth from fiscal drag

With the potential danger that fiscal drag presents to your money, it’s important to consider steps to protect your wealth from tax.

There are many ways you could try and do this, but a popular option is to make pension contributions from income in the higher tax band.

Pensions are considered to be particularly tax-efficient, as money contained within your fund is free to grow from Income Tax and Capital Gains Tax (CGT). As your pension assets are invested throughout your working life, that means they’ll be able to generate interest and investment returns without facing tax.

You’ll also receive tax relief on your contributions up to the Annual Allowance (the lower of £60,000 or 100% of your earnings in 2023/24). Bear in mind that if you have a high income or you’re already retired, your Annual Allowance may be reduced.

Tax relief is applied at your marginal rate of Income Tax, meaning a £100 pension contribution technically only “costs”:

- £80 for basic-rate taxpayers

- £60 for higher-rate taxpayers

- £55 for additional-rate taxpayers.

Basic-rate tax relief is typically applied automatically, while you have to claim for the higher or additional rate through a self-assessment tax return.

Crucially, this means that if you’ve been squeezed into the next Income Tax band, you may be able to claim greater rates of tax relief on any income within that band.

For example, if you went from earning £50,000 to £53,400 as in the example above, you’d be able to claim an extra 20% tax relief on top of the basic rate on the £3,130 that falls into the higher-rate tax band.

This could offset some of the effects of fiscal drag, using your retirement pot to claim back the higher rate of tax you paid.

Want to make your wealth more tax-efficient? Speak to us

If you’d like to find ways to make your wealth more tax-efficient, we can help at Cordiner Wealth.

Email hello@cordinerwealth.co.uk or call 0113 262 1242 to speak to an experienced adviser today.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

All contents are based on our understanding of HMRC legislation, which is subject to change.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.