On 18 September 1989, singer-songwriter Billy Joel released his hit single ‘We Didn’t Start the Fire’.

A track that would appear on the album Storm Front, the song was an instantaneous success for the piano man. It would go on to be nominated for “Record of the Year” at the 1989 Grammys, and was Joel’s third song to reach number one on the Billboard Hot 100 in the US.

The rock song is best known for its fast-paced lyrics, rattling off 119 events that occurred in the 40 years between Joel’s birth in 1949 and 1989, when it was written.

Ranging from political and social events to scientific discoveries and notable sporting achievements, it’s a rather heady revisiting of the nearly half-century of Joel’s life to date at the time.

Coincidentally, the song has become greatly associated with the Cold War, as the time period almost neatly coincides with the fallout from the second world war in the late 40s and the collapse of the Soviet Union that started in 1988.

Joel revealed his distaste for the song in later interviews, seeing it as some of his weaker work. Regardless, it’s a fantastic chronicle of a tumultuous period in time, and its legacy has lived on in the form of new recordings, parodies, and a host of references in pop culture.

Perhaps most interestingly of all, there’s a significant financial planning lesson to learn from the song’s genesis and the events that it covers.

Read on to discover the lesson, and why it shows the immense value of working with a professional.

The song shows the ongoing pattern of uncertainty throughout history

Joel was 40 when he came up with the idea for ‘We Didn’t Start the Fire’ during a conversation with a 21-year-old man. This younger individual was describing many of the world’s problems at the time while describing Joel’s youth as comparatively calm and measured.

In retort, Joel noted events from his own 20s, such as the Vietnam war and the civil rights movement, as well as those from his childhood, including the Korean war and the Suez Canal crisis.

It was from this conversation that Joel realised something significant: every generation has experienced such events. No matter how old you are, you’ll recall these moments of uncertainty throughout the course of history.

This pattern of events, and the bias toward remembering negative information, offered a perfect hook for Joel to write a catchy hit – even if he doesn’t see it that way now.

Crucially, it also offers a key insight into financial planning and investing your wealth. Uncertainty is well known as something that investment markets don’t like. It can lead to falls in market values, as investors buy and sell investments in accordance with world events, such as those in Joel’s song.

But this is exactly the lesson to learn: periods of uncertainty over time are almost guaranteed, and you are going to see the value of your investments rise and fall over time. The key is to learn to stay calm when these events occur.

It’s crucial to remain calm and keep a steady hand on your wealth amid such events

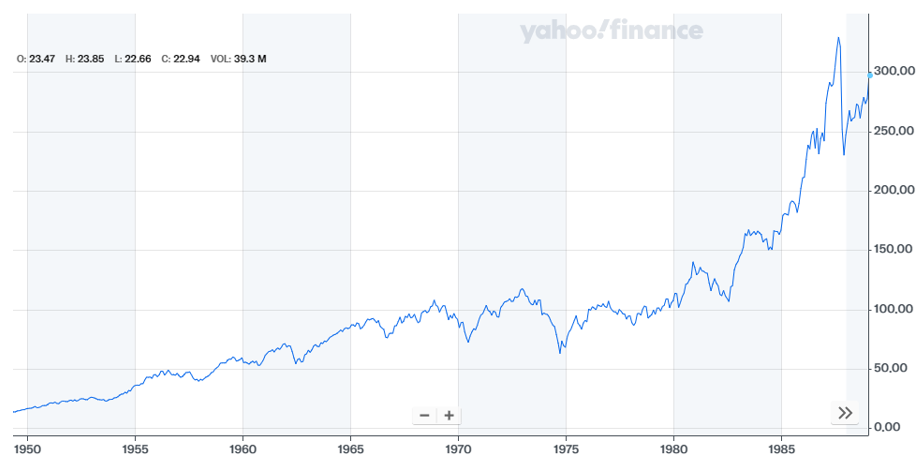

When trying to understand global events and how they affect your wealth, it can be useful to consider historical market data.

Past performance is not necessarily a reliable indicator of what will happen in future. But, it can provide insight into how markets behave and respond to uncertainty and global events.

Consider this graph of the US stock market during the period that Joel was singing about in ‘We Didn’t Start the Fire’:

Source: Yahoo Finance, S&P index (subsequently S&P 500 from 1957) from 31 December 1948 to 1 January 1989.

As you can see, despite the 119 events that Joel mentions, the market continued to climb and increase in value over time.

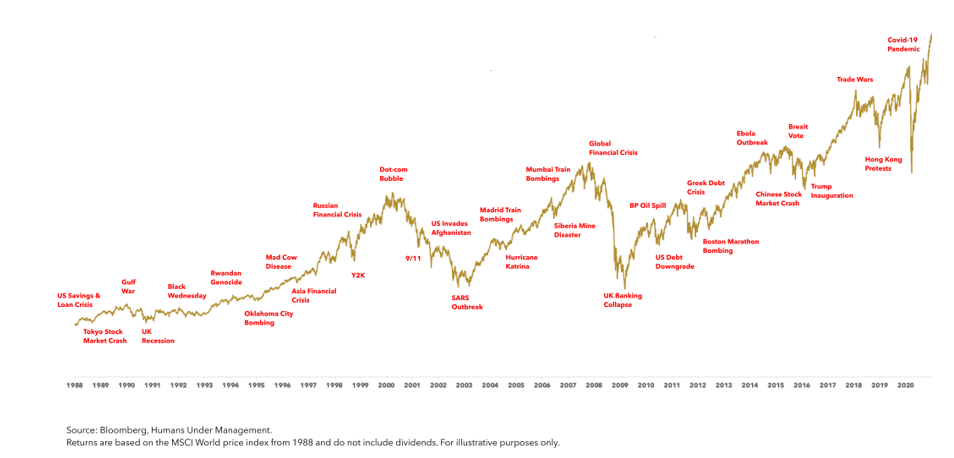

This graph is not an isolated example of a period where this has happened. For example, this chart shows the performance of the MSCI World between 1988 and 2020, annotated with some of the events that would no doubt fall into a retelling of Joel’s hit for the past few decades:

Source: Humans Under Management

Again, despite the uncertainty that these events caused – and indeed the dips in the market that sometimes followed as a result – the trend is ultimately still upward.

All in all, the lesson to learn from this data – and from Joel himself – is that uncertain global events are not necessarily a reason to change your investment strategy. Instead, a patient and considered approach could be more sensible.

We can help you create a financial plan to withstand uncertain events

Of course, knowing that it’s important to stay calm is just half the battle; doing so can be another matter. This is where working with a financial planner can be helpful.

At Cordiner Wealth, we can support you in building a financial plan that’s designed to withstand uncertainty. Using your goals for the future, we’ll help you work out what you need to live your ideal lifestyle.

From there, we’ll invest your wealth accordingly, balancing risk and returns to target the growth that will put you on track toward your ambitions.

Crucially, we’ll design that plan with uncertainty in mind, choosing an appropriate level of risk for you and ensuring that you’ll have options for how to draw an income when markets are low.

We’ll also offer invaluable reassurance and guidance during those periods of uncertainty so that you can be confident that you’re still on track towards living the life you want.

Get in touch

If you’d like to find out how we can help you build a financial plan to last for the next 40 years and beyond, please do get in touch with us at Cordiner Wealth.

Email hello@cordinerwealth.co.uk or call 0113 262 1242 to speak to an experienced adviser today.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.