ISAs are some of the most popular accounts available to UK residents, with government figures showing that there were 12 million adult ISAs subscribed to in 2020 to 2021.

You can contribute money into ISAs up to the ISA allowance each year. This lies at £20,000 in the 2022/23 tax year, giving you a healthy sum to save or invest tax-efficiently.

One key decision you will face when opening an ISA is in choosing which one to go for. While there are various different types of ISAs, two of the most common tend to be:

- Cash ISAs, allowing you to save your money without having to worry about Income Tax on any interest generated

- Stocks and Shares ISAs, giving you the opportunity to invest in a range of assets, with gains entirely free from Income Tax, Capital Gains Tax (CGT), and Dividend Tax.

In the current financial climate, you may be struggling to decide which is most appropriate for you.

For other UK residents, the same government data from the past year shows that Stocks and Shares ISAs are surging in popularity, while Cash ISAs are struggling to attract savers.

Indeed, the figure show that Cash ISAs lost 1.6 million savers in 2020/21. Meanwhile, Stocks and Shares ISA subscriptions increased by a notable 860,000.

So, find out whether a Cash or Stocks and Shares ISA is the correct choice for you right now.

Inflation may erode your wealth in a Cash ISA

The main benefit of a Cash ISA is that any interest your account generates is free from Income Tax. This means you can hold your money in an account away from the stock market, while earning a tax-efficient return on your cash.

There’s no risk to your capital, and up to £85,000 of your savings will typically be protected by the Financial Services Compensation Scheme (FSCS).

However, you can’t have missed inflation in the news over the past few months, as the UK has seen costs surge at the fastest rate for 40 years.

According to the Office for National Statistics, inflation reached 9.1% in the 12 months to May 2022, as the war in Ukraine, supply chain issues, and other such events have seen the cost of living rapidly rise in the UK.

With the rate of inflation this high, it is unlikely that a Cash ISA would provide sufficient returns in interest to maintain the real value of your savings as costs rise.

Indeed, according to data provider Moneyfacts, the highest available rate on an instant-access Cash ISA was 1.30% on 14 July 2022.

If you maximised your entire £20,000 ISA allowance in a Cash ISA receiving 1.30% interest then, assuming that interest is paid annually, you would have £20,260 in a year’s time.

However, a year of inflation at 9.1% would mean £20,000 of goods and services now would cost £21,820 in 12 months’ time.

As a result, your money would have lost value in real terms as, while its literal value has increased, it has less spending power.

Investing is more likely to keep you ahead of inflation

With rising inflation potentially eroding your wealth over time, you might be thinking that a Stocks and Shares ISA may be more suitable to help your money stay ahead of rising costs.

In general, this is true. According to data collated from FE fundinfo, £100,000 invested in the FTSE All-Share Index on 31 December 1999 would have been worth £278,230 on 31 March 2022, assuming dividends had been reinvested.

That’s a total return of 178.2%, with annualised returns of 4.7% a year.

Meanwhile, £100,000 of cash saved in the same time frame would have been worth just £167,660 – a total return of 67.7%, breaking down to annualised returns of 2.4%.

The Bank of England’s inflation calculator shows that inflation averaged around 2.1% a year throughout that period, pushing the cost of £100,000 of goods and services to £153,470.

So, while money in a Cash ISA would have kept you just ahead of inflation throughout that period, a Stocks and Shares ISA containing investments in the FTSE All-Share Index would have comfortably surpassed both.

So, this could be a suitable option if you are considering investing for five years or more.

Obviously, the ISA allowance prevents you from investing £100,000 in a Stocks and Shares ISA in a single tax year.

But you could deposit your money across five years (assuming the allowance remains the same) to generate returns that have historically been better than cash.

Remember: past performance is not an indicator of future performance and markets may not behave as you expect.

Markets are uncertain right now

It’s worth noting that markets are currently notably volatile. Economies around the world are poised for recessions due to the difficult circumstances that many businesses find themselves in, which in turn has seen many markets fall in value.

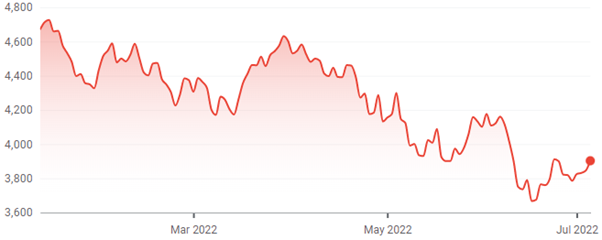

The graph below shows the performance of the S&P 500, an index of the biggest companies in the US, over the past six months, as of 8 July 2022:

Source: Google Finance

As you can see, the index has dropped considerably in these tricky market conditions. So, you need to be conscious of the fact that investments in a Stocks and Shares ISA right now may fluctuate in value in this uncertain market.

That said, it’s worth bearing in mind the evidence that shows long-term investing to be a prudent decision, even during periods of market volatility and dips in value.

Data collated by investment platform Nutmeg shows that, in the 50 years between 1971 and 2021, the probability of loss on equities in developed markets dropped to almost 0% if it was held for 14 years or more.

That’s during a period that includes high levels of inflation in the late 1970s to 1980s, and the 2008 financial crisis.

Obviously, past performance is not an indicator of future performance, and you have the potential to lose value on any investment you make.

But it can be reassuring in shifting conditions to know that holding equities for longer periods can be an effective strategy.

You can divide your ISA allowance across accounts

Of course, nothing stops you from dividing your ISA allowance across accounts as you see fit.

You could save £10,000 in a Cash ISA while investing your remaining £10,000 of allowance in a Stocks and Shares ISA, or any other such split that suits your needs.

This would allow you to have money saved in cash and out of the markets in volatile circumstances, while still making investments for your future that have the potential to outpace interest rates and inflation.

If you’re not certain on what the best choices for your money are, you may want to consider speaking to a financial planner to help you.

A planner can take a look at your entire financial situation and make recommendations based on your life and your goals for the future.

Speak to us

If you’d like to find out the most suitable places for you to hold your money in the current climate, please do get in touch with us at Cordiner Wealth.

Email hello@cordinerwealth.co.uk or call 0113 262 1242 to speak to an experienced planner today.

Please note

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.