After another year of economic uncertainty and significant market volatility, it’s understandable that you may have been finding it difficult to keep on an even keel throughout the year.

According to investing banking giant JP Morgan’s review of markets to November 2022 when data was last available, many of the most common asset classes had experienced significant year-to-date (YTD) declines in value, including:

– Developed market equities, falling 14.1%

– Small cap equities, declining by 15.5%

– Growth stocks, losing 24.4% of their value.

When markets are unpredictable and you’re seeing your invested money lose value, it can be easy to fall prey to feelings of “loss aversion”, a phenomenon identified by psychologists Daniel Kahneman and Amos Tversky.

In research titled Advances in prospect theory: Cumulative representation of uncertainty available from Springer Link, the two psychologists explored the way in which people find the pain of losing to be twice as psychologically potent and influential as the pleasure of winning.

This can lead investors to stop making sensible decisions with their money over the fear of the pain of loss, essentially forgoing the potential of returns to avoid losing at all costs.

During periods like this, it’s crucial to not let such feelings affect your investment decisions. But naturally, this is easier said than done.

So, read on to discover some simple but effective things you can do to help you remove emotions from your investing.

Remember to maintain a long-term outlook

The first thing to do to prevent yourself from making emotional investment decisions is to remember that, historically, markets have tended to rebound and continue to grow over the long term.

As the data from JP Morgan showed, there have been declines across the board for stocks and shares this year. But, when you zoom out and take a longer-term outlook, the figures are far more forgiving.

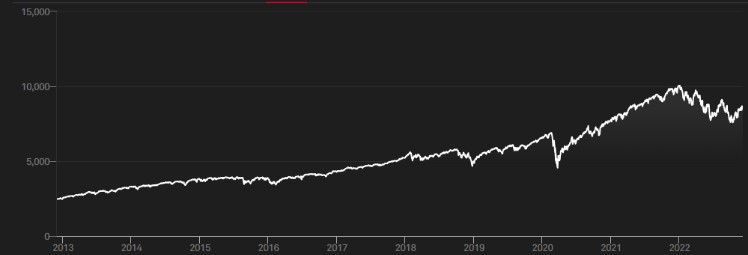

Take a look at this chart showing the 10-year total return performance of the S&P 500, an index of the 500 largest companies in the US by market capitalisation:

The S&P 500 index total returns from 5 December 2012 to 5 December 2022. Source: spglobal.com

Throughout the past decade, markets have been affected by multiple serious events, causing declines in value in:

– 2015-16, during a market sell-off caused by concerns over economic growth and central bank policy, as reported by Reuters at the time

– 2018, with CNBC reporting this to be have been a result of a tightening of monetary policy and the trade war between the US and China

– 2020, as the Covid-19 pandemic and associated lockdowns caused many businesses to struggle.

Yet despite all these events, the graph still shows that the index and its constituents grew in value over time, ultimately generating 10-year annualised returns of 13.16%.

While returns are not guaranteed and you may get back less than you invest, this goes to show the power of a long-term investing strategy, rather than becoming bogged down in weekly or monthly price movements. Remembering this can help to slow your hand and stop you from making investment decisions based on emotions, rather than logic.

As part of this, try to resist the temptation to look at your portfolio every day. This simple yet highly effective method can reinforce the importance of a long-term outlook, as you’re less likely to observe losses the longer you leave your investments.

This perspective is supported by fascinating research from Nutmeg, looking at historical global market data from between January 1971 and July 2022.

Had you invested in a randomly chosen stock during this period for 24 hours, you’d have had a 52.4% chance of making a gain.

But crucially, these odds would have become greater the longer you left your money invested, rising to:

– 65.6% across any random quarter

– 72.8% over one year

– 94.2% over 10 years.

This data suggests that, by not looking at your portfolio every day, you’ll be less likely to see any short-term losses. In turn, this could remove the temptation to sell and realise losses, especially as you’re likely to be better off leaving your money in the market.

Keep your goals in mind

When you invest your money, you typically do so with a target in mind. Whether that’s a short-term goal such as going on a holiday, a medium-term ambition such as buying a home, or a long-term target such as building a retirement pot, you no doubt have specific, personal reasons for looking to grow your wealth.

So, when markets are uncertain and you start to become worried about investing your money, remind yourself of those goals and your reasons for investing in the first place. Otherwise, this can lead you to make emotional decisions that aren’t in your best interest.

For example, imagine that the market drops, and you see your investments lose value. This might lead you to liquidate your investments in fear of them losing more value, falling victim to loss aversion, as we discussed above.

However, by realising losses on investments that might have otherwise recovered given time, you may actually be harming your ability to reach your goals.

After all, as you have seen, investments have historically tended to perform best over longer time frames. This means that ignoring the temporary volatility that you see is crucial in achieving your investment goals, giving your money sufficient time in the market to achieve the returns you’re aiming for.

As a result, by keeping your goals in mind, you may be able to prioritise your long-term investment plan, reducing the chance of the negative effects that your emotions can have.

Work with a planner

In truth, removing your emotions from your investment decisions is practically impossible. While you can certainly recognise loss aversion and try to plan accordingly, it’s still difficult to entirely banish your unconscious thoughts, feelings, and biases.

That’s why working with a financial planner can really add value to you. Rather than allowing your emotions to rule your decisions, your planner can design and manage your portfolio for you, carefully tailored with the right balance of risk and reward.

They’ll also be on hand to make adjustments during those uncertain markets if necessary, taking this burden off your shoulders entirely.

Above all else, the investment decisions your financial planner makes will be based around your goals for the future. That way, you can be confident that your wealth is suitably invested and organised so that you remain on track to achieve your ambitions.

Get in touch

If you’d like help managing your portfolio from an expert, get in touch with us at Cordiner Wealth.

Email hello@cordinerwealth.co.uk or call 0113 262 1242 to speak to us today.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.