Amid market uncertainty and the rising cost of living, there are many financial threats facing you and your money in 2022.

After dipping slightly in August, the Office for National Statistics(ONS) measured inflation to have crossed back into double figures, rising by 10.1% in the 12 months to September 2022.

And, while Sky News reported that UK unemployment had fallen to its lowest level since 1974 in September, the Guardian reports that Goldman Sachs’ prediction of a recession in the UK has become even more concerning. Now, the investment bank expects the UK economy to shrink by 1% in 2023, rather than its previous estimate of 0.4%.

This confluence of rising inflation and economic stagnation has led to fears in the UK of “stagflation”, a phrase coined by politician Iain McLeod during a similar period of difficulty in the 1960s.

Stagflation is understandably a threat to the UK. Inflation together with low economic activity can severely affect your personal wealth, especially your investment portfolio.

So, discover what stagflation is, what it might mean for your invested wealth, and what you could consider doing to reduce its effect on your wealth.

An awkward combination of inflation and economic stagnation

Stagflation is such a danger as it breaks the financial wisdom about the way that inflation and economic activity should theoretically move relative to one another.

Logically, you would imagine that a period of economic stagnation would see inflation fall, as consumers have less disposable income outside of paying their necessary expenses.

In turn, you might expect to see the Bank of England (BoE) cut interest rates to lower borrowing costs and encourage spending, just as the central bank did when the Covid-19 pandemic first affected the economy in 2020.

Meanwhile, a booming economy that’s growing rapidly might experience greater inflation, as high levels of consumer spending drives price growth. In turn, the BoE might raise interest rates to increase the cost of borrowing and encourage saving.

But when there’s stagflation, a gap appears between activity and inflation. Instead, the two move away from one another, seeing costs rise while growth falls.

This makes it difficult for a body such as the BoE to act, as moving interest rates one way or another in this environment could have a negative impact on one of these two key elements.

Businesses may struggle in a stagflationary environment

The risk to your portfolio during a period like this is fairly simple and straightforward: with low economic activity and high inflation, businesses may struggle.

Simultaneously, investors may look to sell their holdings in companies so they can access the cash, driving down share values in the process.

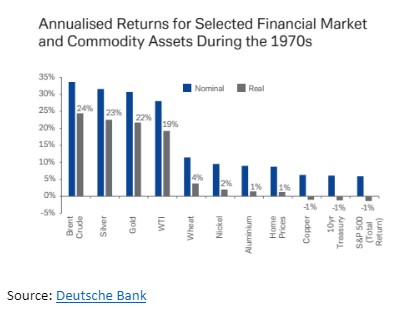

This could see your portfolio decline in value, as equities and bonds across the economy struggle. According to research by Deutsche Bank, this is exactly what happened in the last significant period of stagflation in the 1970s, describing the period as a “terrible decade for equities and bonds across multiple countries”.

Indeed, their figures show that the S&P 500, an index of the 500 largest US companies, had real total annualised returns of -1% during the entire decade.

3 ways to invest during a period of stagflation

With the UK potentially facing stagflation in the coming months, you may well be wondering how you can manage your investments to keep your portfolio on track.

So, here are three ways you could invest that may help to keep you steady during a period of stagflation.

1. Choose “defensive” stocks

Firstly, you could consider adding or increasing exposure to “defensive” stocks in your portfolio.

Defensive stocks refer to those that consumers will continue to use, even during economic downturns.

This could include:

– Utility companies, such as those that produce or provide water, gas, and electricity

– Consumer staples, such as food, clothing, and personal hygiene products

– Property, whether that’s home builders or investment trusts involved with bricks and mortar

– Healthcare companies, such as pharmaceutical producers.

While there’s no guarantee of positive returns on any investment, these stocks may be better positioned to ride out periods of economic instability as their services are typically irreplaceable.

As a result, investing in these companies could bolster your portfolio while markets are so uncertain.

2. Consider commodities

Commodities is a broad category, encompassing everything from oil and wheat to metals such as gold, silver, nickel, and copper.

While the S&P 500 might have produced real total annualised returns of -1% during the 1970s, Deutsche Bank data shows that many commodities actually performed relatively well.

The chart below shows the nominal and real returns of various commodities alongside that of 10-year Treasury Bonds and the S&P 500:

Source: Deutsche Bank

As this chart shows, certain commodity investments performed better throughout the 1970s than either bonds or equities. So, this could make certain commodities a good home for your money in the event that the UK experiences a period of stagflation.

Again, please remember that historical performance does not necessarily indicate what will happen in future. Commodity investments could still lose value in a stagflationary period, and you may get back less than you invested.

3. Work with a professional

Above all else, the most sensible choice in circumstances like these is to work with an expert. A financial planner has the knowledge and experience to guide you through tricky waters like this, ensuring that your money remains suitably balanced to weather a period of stagflation.

At Cordiner Wealth, we can help by designing a portfolio that suits you and your tolerance for risk. Crucially, we’ll tailor your investments to suit your life goals. That way, your portfolio will be carefully aligned with the lifestyle that you and your family want to live in the future.

Get in touch

If you’d like to find out how we can help you manage your portfolio during a period of stagflation, please get in touch with us today.

Email hello@cordinerwealth.co.uk or call 0113 262 1242 to speak to an experienced adviser.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.