You no doubt want the best for your children and grandchildren’s financial future. You may have instilled in them the same prudent values that you’ve lived by, or even given them financial assistance directly.

This support may have directly influenced their decision-making, and may have helped them secure an income that should allow them to achieve the standard of living you’ve been able to enjoy.

However, your child or grandchild may face a hugely different landscape to the one that you’ve experienced. Higher property prices and periods of economic uncertainty – not to mention high inflation throughout the cost of living crisis – could have resulted in them not having accumulated wealth in the way they might have expected despite their high earnings.

In this case, they may well be a “HENRY”.

Your child or grandchild could be a HENRY if they have high earnings but are not yet “rich”

HENRY is an acronym standing for “high earner, not rich yet”. This label describes those who earn high incomes but are still struggling to build wealth due to high expenses, and may well apply to your own children or grandchildren.

There’s a paradox to being a HENRY. Many may perceive them as being affluent, but they might not be experiencing the benefits most commonly associated with the accumulation of wealth. In fact, Investopedia refers to them as “the working rich”, where their perceived wealth comes from a steady income rather than from investments, property, or other assets.

For this reason, they can face unique financial challenges as they navigate building their wealth, managing taxes, and planning for the future.

However, HENRYs may have more potential than others to save and invest their money, effectively increasing their wealth.

Helping them understand this through open communication could be incredibly beneficial. But arguably, the most effective way you could help them is by introducing them to your financial planner.

Here are three compelling reasons why you may want to consider introducing your HENRY children or grandchildren to your financial planner.

1. It could help ensure they manage their wealth responsibly

One of the primary reasons to include your HENRY children or grandchildren in your financial planning is to help them manage their wealth responsibly.

Most HENRYs are typically young professionals, often in their 20s or 30s, with high salaries but also high expenses. They may favour city life, have student loan debt, and a desire to enjoy the fruits of their hard work.

As you have discovered throughout your career, while it is important to enjoy the rewards of hard work, it’s equally as vital to establish sound financial habits early on. This could include:

- Building an emergency fund

- Securing adequate financial protection

- Developing a long-term savings and investment strategy, including contributing to a pension.

Many HENRYs, despite their high incomes, may struggle with budgeting, debt management, and long-term planning.

Indeed, according to research published in Money Marketing in 2022, higher earners tend to borrow more than those on lower incomes, and are more likely to have borrowed at a higher percentage of their income.

So, by introducing your child or grandchild to your financial planner, you could facilitate the start of a new financial chapter, guiding them towards making informed decisions that will benefit them in the future.

This proactive approach can help them get the basics in place, such as regular saving and investing. It might also prevent them from falling into the potential traps of overspending, borrowing more than they can afford, or making risky investment choices that don’t align with their risk tolerance or long-term goals.

2. It could show them the importance of minimising their tax burden

HENRYs often face a significant tax liability due to their high earnings. They may not be aware of the various tax-efficient strategies available to them and, as a result, are potentially spending a substantial portion of their income on taxes.

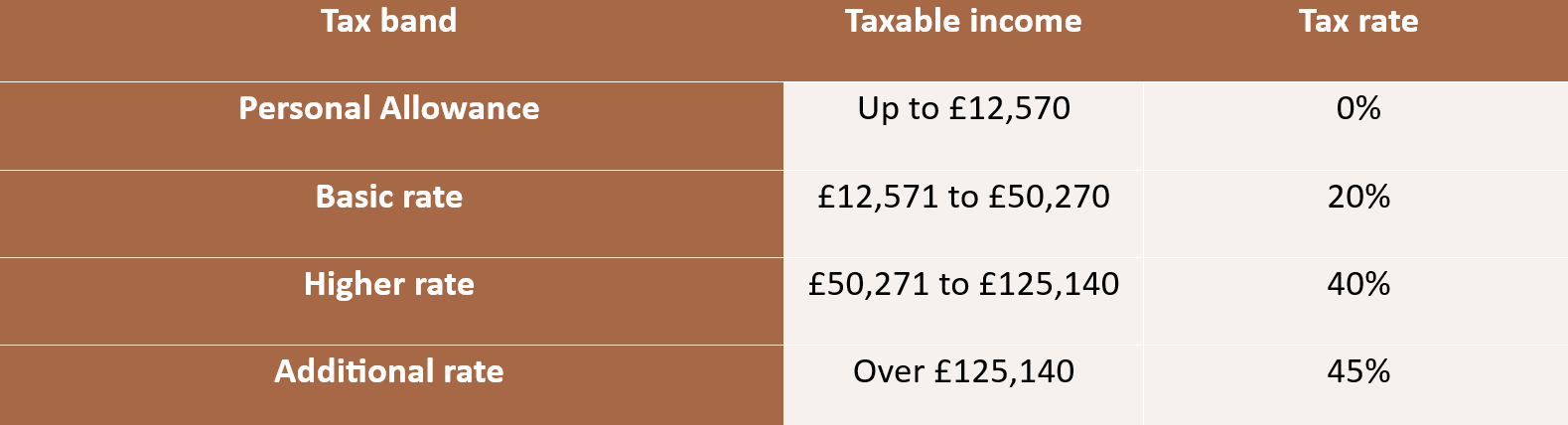

For example, they may well know how the Income Tax thresholds work, progressively increasing their tax bill the more they earn. The table below details the Income Tax bands in the 2024/25 tax year:

However, what they might not know is that, after their earnings reach £100,000, their tax-free Personal Allowance starts to fall by £1 for every £2 over this threshold.

As they lose part of their Personal Allowance, they will also pay 40% Income Tax on earnings that were previously tax-free. In effect, this sees them pay a marginal Income Tax rate of 60% on earnings between £100,000 and £125,140, where the additional-rate tax band starts. This is also known as the “60% tax trap” and it can be challenging to manage.

So, even though your child or grandchild’s earning potential is significant, they may not yet have the financial knowledge or experience to manage their wealth effectively in the face of rules like this.

Fortunately, this is where financial planning can be helpful. An experienced planner can help your child or grandchild with tax-efficient strategies to manage this liability, such as paying more of their earnings into a pension to reduce their taxable income and recoup the 60% charge through tax relief on their contributions.

This is just one example of how encouraging a HENRY to explore financial planning could help them minimise their tax burden.

3. They might better understand the benefits of joined-up financial planning for the family legacy

Including your HENRY child or grandchild in your financial planning could help foster a sense of shared and individual purpose with you as a family. In turn, this might allow for a more joined-up, cohesive family plan.

Having these conversations may encourage them to think about their finances not just in isolation, but within the context of the family’s overall financial goals.

In particular, this could involve discussions about estate planning and inheritance, which may be valuable for you to discuss with them. You can explain how your wealth is organised and what they might be set to receive from you in future, so there are no surprises when it comes to inheriting from you.

Making this an open dialogue can also give you the opportunity to reaffirm the importance of managing this windfall responsibly. You can note how the wealth they’re inheriting from you could be crucial in helping them to achieve their goals, provided they plan carefully with it.

Finally, it might also influence them to consider their own arrangements for their children or beneficiaries. In this way, your legacy will not just be the wealth you leave behind, but the positive financial habits you instil in them.

By working together, you could create a plan that aligns with everyone’s interests and maximises the benefits for the entire family.

Get in touch

We can help facilitate these important conversations and develop a joined-up plan that suits everyone’s needs. Talk to us about how we can help you and your family achieve your financial goals, together.

Email hello@cordinerwealth.co.uk or call 0113 262 1242.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All information is correct at the time of writing and is subject to change in the future.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The Financial Conduct Authority does not regulate estate planning or tax planning.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates, and tax legislation may change in subsequent Finance Acts.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.