At the end of July, new chancellor Rachel Reeves revealed what she claimed to be a £22 billion hole in the government’s finances. She pointed the finger at the outgoing Conservatives, with Reuters reporting her criticisms of “past overspending and a failure to allocate sufficient resources to meet investment commitments and demands on public services”.

This gap in the public finances will need addressing, and raising taxes is certainly a possibility for how the government will choose to do so.

The Labour Party’s manifesto was quite clear that it would not seek to raise certain taxes, a promise that Reeves has subsequently committed to in interviews. Taxes that Labour have said will not be increased include:

- Income Tax

- National Insurance

- VAT

- Corporation Tax.

However, this pledge makes no reference to Inheritance Tax (IHT), pension tax relief, or Capital Gains Tax (CGT). Any one of these three elements could be consequential for you, and CGT could be especially relevant if you own a business.

Business owners have been aware of the threat that changes to CGT could pose even before the Labour Party came to power. In fact, according to the Financial Times, many business owners were rushing to sell their companies ahead of the general election, for fear that a Labour government could reform CGT. Otherwise, they may have faced a greater tax bill on the sale of their business.

It remains to be seen whether Reeves will make changes to the CGT regime, and it’s likely we won’t find out until the chancellor’s first Budget on 30 October.

But in the meantime, it’s worth being aware of how CGT works, what changes could be introduced, and what this could mean for you as a business owner. Read on to find out more.

Capital Gains Tax is payable on gains when you “dispose of” an asset

You may have to pay CGT when you sell or “dispose of” an asset and generate a gain. This can include assets such as:

- Stocks and shares held outside of an ISA

- Certain material possessions (excluding your car), such as art or jewellery

- Second properties (your main residence is excluded from CGT)

- Business assets, such as land and buildings, fixtures and fittings, and plant and machinery.

CGT only applies to gains you have made on an asset, not on the asset’s entire value. For example, if you bought shares outside an ISA for £10,000 and they grew to become worth £15,000, only the £5,000 gain would potentially be liable for CGT.

Before CGT becomes payable, you have a tax-free threshold for gains called your “Annual Exempt Amount”. This allows you to generate CGT-free gains each tax year and stands at £3,000 in 2024/25. This has significantly reduced in the past three tax years; in 2022/23, the exemption was £12,300, before being brought down to £6,000 in 2023/24 and subsequently £3,000 from 6 April 2024.

Once you have gains that exceed the Annual Exempt Amount, you may face CGT on them. This is charged at:

- 10% (18% on property that isn’t your main residence) for basic-rate taxpayers

- 20% (24% on property that isn’t your main residence) for higher- and additional-rate taxpayers.

It’s worth noting that business owners may be able to apply for Business Asset Disposal Relief (BADR) when selling CGT-eligible business assets. This sees all business assets attract a CGT rate of 10%, even if you are a higher- or additional-rate taxpayer.

Labour could seek to increase the government’s Capital Gains Tax receipts

With a hole in the public finances to fill, CGT is certainly one area that the government may seek to reform to increase receipts. There are various changes that the chancellor could make to do this.

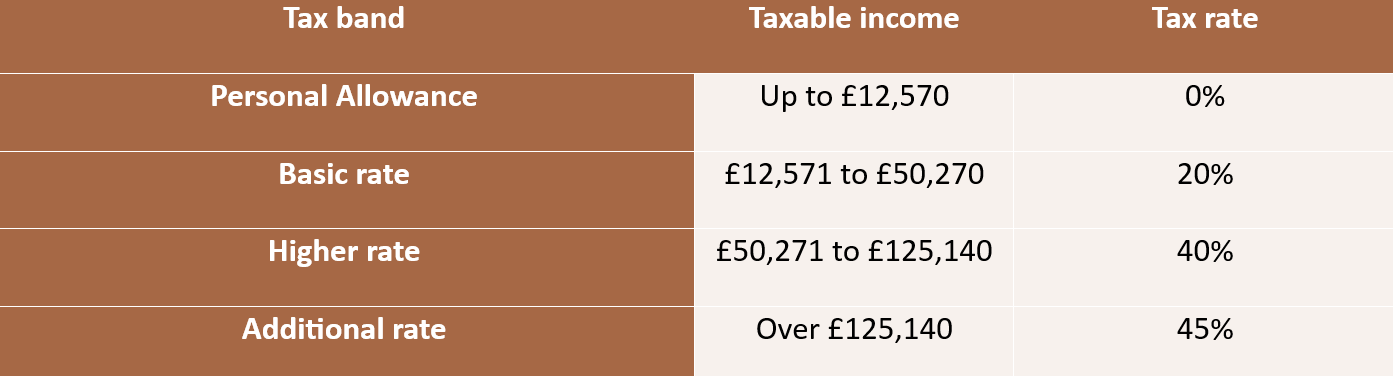

For example, one option is to bring the CGT rates in line with Income Tax. The table below details the rates of Income Tax in 2024/25:

This would essentially double everyone’s CGT liability, with additional-rate taxpayers facing an even higher uplift.

Alternatively, the government could further reduce the Annual Exempt Amount, or perhaps abolish it entirely. This would mean a greater proportion – or even all – of your gains would become taxable.

Another option that could affect you specifically is the abolishment of BADR. If you’re a higher- or additional-rate taxpayer, this would see you face the 20% CGT rate when selling business assets, rather than benefiting from a potential tax break.

Capital Gains Tax reforms could put a significant dent in your returns from a business sale

Changes to the CGT regime could provide a substantial sum to the government, affecting various areas of wealth, from investments to property transactions.

However, these could be especially consequential if you’re considering selling up and moving on from your business soon.

The removal of a CGT-free threshold of £3,000 might not seem too steep in the context of a sale worth multiple hundreds of thousands or even millions of pounds.

But, an effective doubling in the tax rate or the scrapping of a tax relief like BADR could make a big difference to you. It might mean needing to ask a buyer to pay more for your business to cover the shortfall, or even for you to think again about how you’re going to fund the next stage of your life.

In this case, you may want to consider if there’s anything you can do now to reduce the impact a change could have. For example, could you start selling certain business assets now to lessen the size of the bill you’ll face down the line?

It’s important not to panic ahead of announcements

Of course, as with any change to financial rules and regulations, it’s important not to panic and make impulsive decisions before anything is announced.

Indeed, those who rushed to sell their businesses before the general election might retrospectively wish they hadn’t done so, as nothing immediately changed on 4 July. Those business owners might have made decisions that weren’t actually in their best interest, for fear of changes to the tax regime.

A knee-jerk reaction could lead you to rush into a business sale, perhaps leading you to settle for a lower sale amount than you might otherwise have received. Or, you might sell to a buyer who isn’t aligned with your business values or ethos, putting all your hard work into the hands of someone who won’t treat your staff, customers or clients with the same respect you do.

This might even be for nothing if the government ends up not making changes to CGT anyway. So, before you react, it’s worth taking a beat and assessing whether you have any other options before diving in.

It could be sensible to speak to a professional tax adviser. They may be able to support you in finding a tax-efficient solution to a business sale, either now or after changes are implemented.

Get in touch

Need help organising your wealth as a business owner? At Cordiner Wealth, we can provide you with a bespoke financial plan so that you can make the most of all the hard work you put into your company.

Email hello@cordinerwealth.co.uk or call 0113 262 1242 to find out more.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All contents are based on our understanding of HMRC legislation, which is subject to change.

The Financial Conduct Authority does not regulate tax planning.