June 2024 has been remarkably cold in the UK. The Guardian reports that, although 1975 holds the accolade for the coldest June on record, meteorologists agree that this month has been “exceptionally unseasonably cold”.

Whenever we experience bizarre weather like this, your first thought might go to climate change. A deviation from the normal weather prompts concerns over the human impact on the planet and how it disrupts these systems, leading us to reflect on how we can reduce this.

No wonder, then, that investors in the UK highly value the opportunity to invest their wealth sustainably. According to figures from the Financial Conduct Authority (FCA) – the UK’s financial regulator – 81% of adults would like their investments to do some good, as well as generate a financial return.

However, this can be made difficult by the variation in what’s considered “sustainable” or “green”. Furthermore, some financial providers and individual companies have been accused of “greenwashing”, purporting to meet criteria that they arguably do not.

As a result of this, the FCA introduced new rules on 31 May 2024 that mean sustainability-related claims around investment products must now be “fair, clear, and not misleading”.

Furthermore, there will be new sustainability labels starting from 31 July 2024 that firms can use to explain exactly how their investment products benefit people, the planet, or both.

So, read on to find out what sustainable investments involve, why they have been controversial, and what the FCA’s new rules seek to do to help investors make the right decisions.

Sustainable investments aim to help investors align their wealth with their values

While the concept of aligning investments with values has been around a lot longer, the idea of sustainable investing as we know it today started in the 1960s.

Back then, it was known as “socially responsible” investing and often related to avoiding certain “sin stocks”, such as tobacco or arms producers.

Now, although the core concepts are roughly the same, this method tends to have various names. You might see the term “sustainable investments” bandied about, or perhaps see such options referred to as “ESG investments”.

While similar to the original core concept, these terms seek to be more specific about what’s involved in the investment.

For example, “sustainable” usually refers to investments that are beneficial in some way to people or the planet. Meanwhile, the ESG acronym stands for:

- Environmental – This refers to companies that seek to tackle climate change in some way, such as companies that produce sustainable energy. It could also include companies that seek to limit their impact on the environment.

- Social – This label is applied to businesses with high social performance. This could be with their employees, local communities, or people in general. It might also involve avoiding those sin stocks mentioned above that can have negative social outcomes.

- Governance – The final part of the puzzle is how a company behaves at boardroom level. From diversity and inclusion to anti-bribery and corruption protocols, this measures how ethical companies are from top to bottom.

Expanding the range of language is supposed to allow investors to find those companies and funds that align with their individual values as closely as possible, based on a wider range of criteria.

Greenwashing has plagued sustainable investments over the past few years

The thinking behind sustainable and ethical investments no doubt has its heart in the right place. However, the marketplace of sustainable options has become somewhat muddied by the rise of greenwashing.

This sees companies labelled as “green” or included in sustainable funds, even when they might not actually be that sustainable or ethical.

It might be a deliberate effort on the part of a company to present themselves as environmentally or socially friendly when they are not so they will be included in a sustainable fund.

Alternatively, the bank, fund manager, or provider might have claimed that the product does more for people or the planet than it actually does.

Or, it might be as a result of the complicated nature of defining what “sustainable” or “ethical” actually means. For example, one person might think that a fund containing companies focused on animal agriculture is fine, while someone else might not.

This is no small problem.

According to the Guardian, in 2023, a climate think tank called Carbon Tracker Initiative assessed sustainable pension funds and found that more than 160 funds with a “green” label held $4.6 billion in some of the world’s largest oil and gas companies.

Had you been invested in these funds for their positive environmental slant then you might have been disappointed to find out that your wealth had been in some of the biggest carbon polluters in the world.

Similarly, investment giant BlackRock came under fire in 2021 after claiming that sustainability would be the firm’s “new standard for investing”. Yet, the company had as much as $85 billion invested in coal, Yahoo Finance reports.

Part of this issue comes down to the labels. For example, the environmental strand of the ESG acronym has space for companies that make an effort to reduce carbon emissions in their supply chains, even if the bulk of their business is still environmentally unsustainable.

So, these providers or companies might not have even thought they were doing anything wrong.

The FCA’s new rules aim to reduce greenwashing and help consumers find suitable investments

All this has led to the FCA stepping in to provide financial product providers with clearer guidance as to what criteria sustainable investments must meet.

Since 31 May 2024, all FCA-authorised firms are now required to provide evidence if they make environmental claims about their products or services, and to make these claims “fair, clear, and not misleading”.

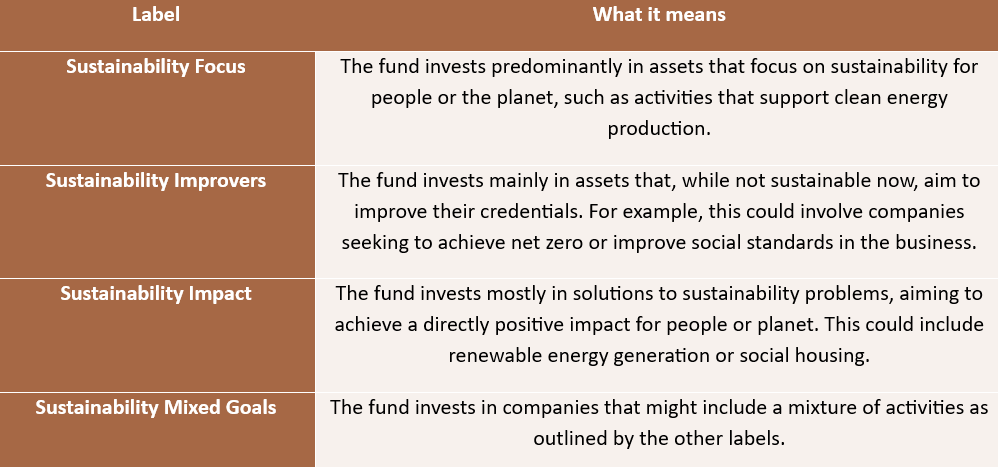

Then, from 31 July 2024, firms will be able to start using one of four new investment labels on their products, as outlined in the table below:

Source: Financial Conduct Authority

Moving forward, you might notice financial providers using these labels to designate their sustainable investment options.

Providers don’t necessarily have to use these labels, and can continue using language such as “green” or “carbon neutral”, so long as they’re able to provide evidence for these claims.

The final elements of the FCA’s new rules will come into effect from 2 December 2024. From this point, there will be new naming and marketing requirements for asset managers that prevent products from being described as having a positive sustainable impact if they don’t.

Altogether, these new rules will hopefully help you find options that suit your individual ethical and sustainable goals when investing your wealth, allowing you to align your investments with your values and reducing the chances of greenwashing.

Get in touch

If you’d like to find out more about investing your wealth, please do get in touch with us at Cordiner Wealth.

Email hello@cordinerwealth.co.uk or call 0113 262 1242 to learn how we could help you.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.