If you’re looking for ways to manage surplus cash in your business, property could be an effective tool to store yours.

Buying property allows you to make a purchase on a solid, tangible asset that could increase in value over time.

Property prices hit an all-time high in 2021. So, if you’d taken the plunge with a surplus last year, you’d have already made a tidy profit.

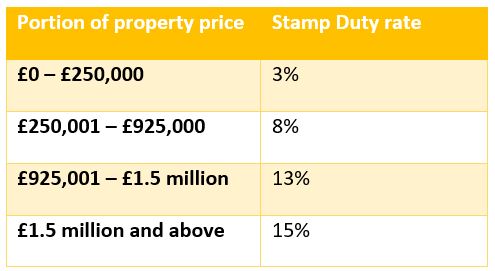

Another issue is that, while you might mitigate Income Tax, a property purchase is unlikely to be entirely tax-free. Firstly, you’ll have to pay Stamp Duty when you make your purchase, the total of which will depend on the price of the property.

Stamp Duty rates on Buy-to-let properties

Then, if you decide to rent the property out, any payments you receive will count as income, meaning you’ll have to pay Income Tax on them.

Property is an illiquid investment as, when you come to cash in on any equity gained on the property, there’s no guarantee you’ll be able to find a buyer.

And, even if you do, you still may have to pay Capital Gains Tax (CGT) if its value has increased by more than your personal CGT allowance – currently £12,300 in the 2021/22 tax year.

Pros

- A good asset for storing wealth

- The value could increase over time.

Cons

- Illiquid and could be difficult to sell

- Exposes you to other taxes, including Stamp Duty and CGT.

If your only goal is to directly avoid Income Tax, you’ll need to calculate whether the costs of the property make it worthwhile.

Want to find out more?

You can download your free guide to learn more about this strategy, as well as six others for managing surplus business cash.

You can download your free guide right here.

Alternatively, please email hello@cordinerwealth.co.uk or call 0113 262 1242 for more information.

Please note

Property can be an illiquid investment, meaning it can be more difficult to access the value than with other types of investment. Additionally, you may incur costs when selling a property, whereas encashing other investments may not give rise to a charge. The value of property can also fluctuate, meaning that you may get back less then you paid.

Buy-to-let (pure) and commercial mortgages are not regulated by the FCA.