Holding cash has long been thought of as a safe way to keep your money: it’s easily accessible and there’s not too much risk of losing it.

However, while it can be safe to keep your money as cash in a savings account, holding on to too much cash could actually be bad for your long-term financial health. In reality, it could pay to diversify where you hold your money, from cash and bonds, to equities, commodities and property.

Here are five reasons why you shouldn’t hold too much of your money as cash.

1. Cash savings lose value over long periods

In the short term, having cash is not an issue. It’s obviously important and prudent to have savings that you can dip in and out of for everyday use or emergencies.

However, cash can potentially start to lose value over long periods of time if the interest rate you’re receiving is lower than the rate of inflation.

Imagine you put £1,000 in a savings account in 2010. Using the Bank of England’s inflation calculator, we can estimate that goods and services costing £1,000 in 2010 would have cost £1,311.26 in 2020, as inflation averaged 2.7% a year.

However, the average interest rate on a savings account was roughly 1.7% over the same period. Therefore, that same £1,000 held in an easy-access savings account would have only climbed to around £1,170.

This means your money would have lost value in real terms.

2. The interest your cash receives may be taxed

If you’re holding a substantial amount of cash in savings then the interest your cash makes may be subject to tax, especially if you’re on a high income.

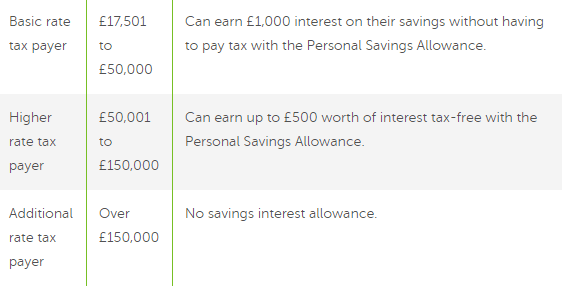

Depending on your income, you may have a Personal Savings Allowance that means a certain amount of the interest you can make on your account is tax free.

Source: Money Advice Service

However, if you’re holding most of your savings in cash, this could mean you’ll end up paying tax on them.

Keeping your cash in an ISA can help alleviate this issue, as interest paid on money in a Cash ISA is tax free. However, there is an annual limit to how much you can put in an ISA in each tax year, which is £20,000 for 2020/21, so you may not be able to move all your cash in one tax year.

3. Interest rates could go below 0%, meaning you could pay a bank to hold your savings

Recently, the Bank of England has indicated that it may take the unprecedented step of introducing negative interest rates.

The Bank of England already slashed the base rate in March 2020 to an all-time low of 0.1% in response to the coronavirus pandemic. However, it has now told commercial banks to prepare for negative interest rates in the next six months after the UK economy shrank by a record 9.9% in 2020.

This would mean commercial banks have to pay to hold their cash with the Bank of England, rather than receiving interest on it. This incentivises the banks to lend their money instead of holding it as cash, the idea being that money lending will help boost the economy.

However, these charges could be passed onto you in the form of a negative interest rate on your savings account. Negative interest rates could mean you have to pay a bank to deposit your money.

4. Investments often outperform cash holdings in the long term

The most common alternative to holding cash is to invest it, usually in the stock market.

While investments often fluctuate in value more than cash savings, investing can produce better results in the long term.

The Barclays Equity Gilt Study 2019 analysed performance of cash, equities and gilts from 1899 to 2018. The study found that £100 invested in cash in 1899 would be worth just over £20,000 today. Meanwhile, £100 invested in equities would be worth around £2.7 million today.

Of course, these figures show growth over a time frame of more than a century, but it’s a good indication of how investments can produce better returns than cash.

Bear in mind, the value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

5. Cash savings don’t benefit from dividend payments

The other advantage of investments over cash is that shares can often pay dividends.

In an example from Hargreaves Lansdown, a £10,000 investment in a company at 100p per share and an annual dividend payment of 5% (5p per share) would produce an extra £500 a year. This means that, assuming the price of the share and the dividend payment remains the same, in 20 years the investment could be worth £20,000.

You can also reinvest your dividend payments into shares, giving your investments an extra boost without having to invest any more of your cash.

However, don’t forget that companies can suspend dividend payments, so they are not a guaranteed source of income.

Get in touch

If you’re concerned about low interest rates, or what holding too much cash could mean for you, get in touch to find out how we can help. Please email hello@cordinerwealth.co.uk or call 0113 262 1242.

Please note:

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.