One of the most rewarding parts about running your own business is that you can be the biggest beneficiary of all your hard work. The income you generate from providing your product or service will be the wealth you use to fund your lifestyle and ultimately reach your financial goals.

Of course, when extracting wealth from your business, it’s crucial to ensure that you’re as effective and tax-efficient as possible when doing so. You have various options for doing this, each with their own pros and cons, too.

So, find out three common methods of extracting wealth from your company, and the advantages and potential drawbacks of using them.

1. Paying yourself a salary

First and foremost, you’re in control of the director’s salary you pay yourself. This is arguably the simplest way to extract wealth from your company, with you receiving your income on a monthly basis like any other employee.

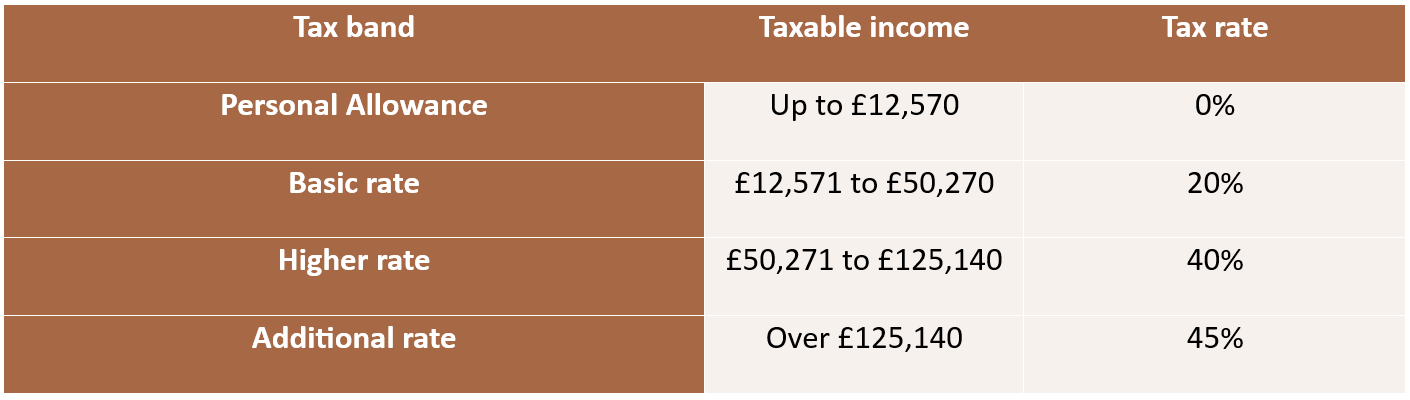

When you do so, your salary will be potentially subject to Income Tax, depending on how much you draw from your business and receive from any other sources. The table below shows the Income Tax rates in the 2024/25 tax year:

Pros of paying yourself a salary

The main benefit of paying yourself a salary is that it gives you a steady income you can use to meet your regular financial obligations. You can be confident in how much you take home, and use it in whatever way you wish, whether you pay your bills or save and invest it for the future.

A salary can also be useful in cases such as borrowing for a mortgage. A lender can consider your salary when deciding how much you’re able to borrow.

Cons of paying yourself a salary

Perhaps the most notable downside of paying yourself a salary is Income Tax. As you saw above, Income Tax increases significantly once you cross into the higher-rate threshold.

So, if you’re going to take a salary, you may want to do so with those tax bands in mind, tactically paying yourself around them or finding ways of mitigating that bill, such as with tax-efficient investments. Otherwise, you may end up with a larger tax bill than you intend.

Additionally, you may have to pay Class 1 National Insurance contributions (NICs) on salaried wealth, further eating into your take-home pay. These will be in addition to the NICs your company pays depending on profits.

2. Taking dividends

As a director and most likely the majority shareholder in your business, taking dividends can be an effective method for you to take wealth from your company.

To do so, you’ll need to hold a board meeting with all relevant shareholders and agree on a dividend. It’s important to keep an accurate record of how much you’re paying, and to who.

From here, you can pay yourself the relevant number of dividends depending on how many shares you hold.

Any dividends you pay yourself or you receive from other sources such as investments are then subject to Dividend Tax.

Before tax is due, you have an annual Dividend Allowance each tax year. In 2024/25, this stands at £500.

The rate of tax you’ll face on dividends in excess of your Dividend Allowance then depends on your marginal rate of Income Tax, as shown in the table below:

Pros of taking dividends

A benefit of dividends is that they’re quite flexible. As the director, you can choose when to distribute dividends and how much to pay.

Additionally, dividends are relatively tax-efficient. Although the tax rates might seem steep, you can benefit from the tax-free Dividend Allowance, and the tax rates are more competitive than the Income Tax you might face on salary.

Furthermore, if your spouse or partner is a shareholder, they’ll benefit from their own Dividend Allowance. And, if they’re in a lower Income Tax band than you, they’ll face a lower rate of tax on the dividends they receive, too.

Cons of taking dividends

While Dividend Tax rates are lower than on salaried income, it’s still a notable expense. You may need to factor this in when drawing dividends, as you might receive less than you expect.

Furthermore, the previous government steadily reduced the Dividend Allowance over the past couple of years, falling from £2,000 in 2022/23 and £1,000 in 2023/2024 to where it is now in 2024/25.

While this isn’t a direct disadvantage, it does mean dividends are slightly less tax-efficient than they were in previous years. The Dividend Allowance could be subject to further change, too.

You’ll also have to pay these dividends to all shareholders, and they’ll be entitled to whatever rate you set for these dividends. This could see your profits go to your other shareholders as well, unlike salaried pay that can differ or that shareholders may not be entitled to if they don’t work in the company.

3. Making pension contributions

Instead of extracting wealth for the here and now, you could instead choose to pay yourself by contributing to your pension.

In doing so, you can take profits from your company and set them aside in a dedicated retirement fund.

Pros of pension contributions

If tax efficiency is your main concern, making pension contributions is arguably the most effective choice at your disposal.

When you contribute to your pension, you typically receive tax relief at your marginal rate of Income Tax on contributions up to your Annual Allowance – in 2024/25, this is up to £60,000 or 100% of your earnings, whichever is lower. In essence, this means a £100 pension contribution technically “costs”:

- £80 for basic-rate taxpayers

- £60 for higher-rate taxpayers

- £55 for additional-rate taxpayers.

Furthermore, paying into your own pension as a business owner is treated as if it were an employer contribution. As a result, it’s considered an “allowable business expense” for tax purposes.

That means you won’t face Corporation Tax on your contributions, making this an even more tax-efficient option.

Your pension wealth will also usually be invested, with any interest or returns generated free from tax. So, your pot could increase in value over time, too.

Cons of pension contributions

Of course, the drawback of paying yourself through pension contributions is accessibility. This is a pot designed for retirement, and you typically can’t start drawing your pension savings until you reach age 55 (rising to 57 in 2028).

As a result, this won’t be an appropriate option for providing yourself with an income throughout your career.

Additionally, the annual limit for pensions may prevent you from contributing as much as you’d like to your pot. In fact, your Annual Allowance may be reduced if your earnings exceed certain thresholds or you have already flexibly accessed your pension.

It’s worth keeping these aspects in mind before prioritising your pension.

We can help you find the most appropriate methods of drawing wealth from your business

Deciding which of these options is most suitable for you and your business is tricky. You’re completely entitled to combine them as you see fit too.

If you’d like support working this out, we can help at Cordiner Wealth. We’ll design a strategy to help you extract wealth from your business as effectively and tax-efficiently as possible.

Crucially, we’ll do so with your long-term goals in mind, designing a financial plan that allows you and your family to live the kind of lifestyle you want.

Want to find out more about how we can help you? Simply email hello@cordinerwealth.co.uk or call 0113 262 1242 to speak to us today.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The Financial Conduct Authority does not regulate tax planning.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates, and tax legislation may change in subsequent Finance Acts.